Capital Raising

Significant experience executing debt and equity raises

Capital raising

Capital raising is an important aspect of BCA’s investment banking practice. We help clients evaluate a range of funding alternatives, offer advice on the best alternative and execute the financing alongside the client. We bring true senior-level attention from start to finish and deliver the best deal to our clients.

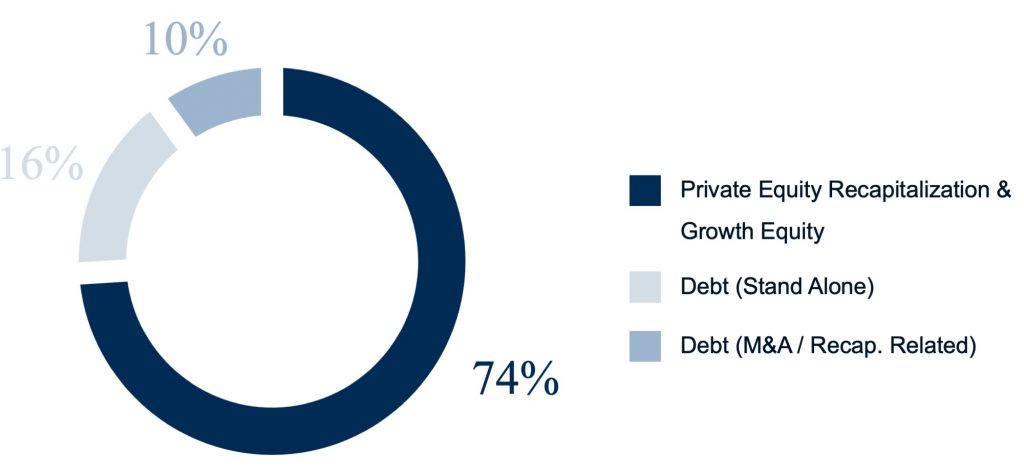

Capital raising ($ volume)

Private equity

Most of our private equity raises fund M&A and organic growth initiatives for our clients. Our average private equity raise for a M&A financing is approximately $40 million. For rapidly growing clients with highly visible, recurring revenue, we typically raise between $10 and $30+ million in growth equity.

Senior and subordinated debt

Our minimum senior and subordinated debt raise amount is $20 million. Typically, we only consider this financing alternative for clients with EBITDA in excess of $5 million.